We Accept Patients regardless of ability to Pay. If you are uninsured and need assistance please see the information below.

Sliding Scale Fee Policy

PURPOSE

To assure that no patient will be denied health care services due to an individual’s inability to pay for such services and to assure that any fees or payments required by the center for such services will be reduced or waived to enable the center to fulfill the assurance.

SCOPE

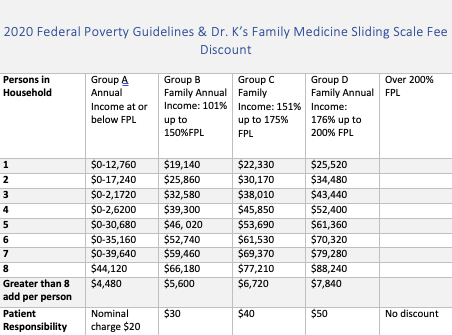

For all eligible patients, a discounted fee will be charged per visit according to the private pay plan as determined by the income guidelines. The discounted fee will cover all in-scope services provided at Dr. K’s Family Medicines (Dr. K’s) for which Dr. K’s administers billing and collections functions. The sliding scale fee does not apply to the therapeutic THC clinic or medical weight loss therapy.

POLICY

Dr. K’s provides care to eligible patients through the establishment of a sliding fee scale discount schedule based on federal poverty guidelines. The sliding fee policy is reviewed and updated annually with current Federal Poverty Guidelines and to ensure nominal fees and copays do not create a financial barrier to care.

APPLICATION PROCESS FOR SLIDING FEE PROGRAM

Complete proof of income* and a sliding fee program application will be expected form the applicant. Patient bills will be adjusted to the appropriate discount level once the sliding fee program application is completed and proof of income is received. Patients qualifying for the sliding fee program will have 30 days from the date the first patient bill is sent to provide documentation. Once 30 days has elapsed, sliding fee discounts cannot be applied to that date of service. If the patient reports no income, they may, in lieu of proof of income, submit a self-attestation of zero income form. Once the household has completed the application process for the sliding fee program, the discount level will be listed in the practice management system. The discount level will be effective for one year.

Proof of Income – Documentation of income must reflect current income and should clearly indicate pre-tax income and any adjustments. Documentation includes, but is not limited to:

- -Most recent income tax return or W-2.

- -Two most recent pay stubs.

- -Most recent unemployment check.

- -Proof of other household income (Social Security, pension, etc.).

- -Bank statements showing direct deposits.

Click here for application